Expanding the Ledger - I

Purchases, Purchases Returns, Sales and Sales Returns

Many businesses are involved in buying and selling. The stock accounts of these businesses are therefore going to be very busy indeed, with large numbers of transactions to be entered. To keep things simple, four additional accounts are used to record the different events that change the amount of stock. These are: purchases account, purchases returns account, sales account and sales returns account. They may be thought of as subdivisions of the stock account.

PURCHASES

Purchases of stock increase the value of this asset. What kind of entry in the stock account shows this? If you have mastered the rules in the last chapter, you should have said ‘debit’. Instead of making the debit entries in the stock account, we are going to enter all such debits in a purchases of stock account, which for convenience will be called the purchases account.

In which account will the corresponding credit entry be found? This will depend on the method of payment. If payment is made immediately the credit will be entered in the cash or bank accounts, showing the reduction of an asset. If the goods (as stock is sometimes called) are bought on credit then the credit will be entered in the account of the supplier, who is a creditor to the purchaser. This shows the increase of a liability.

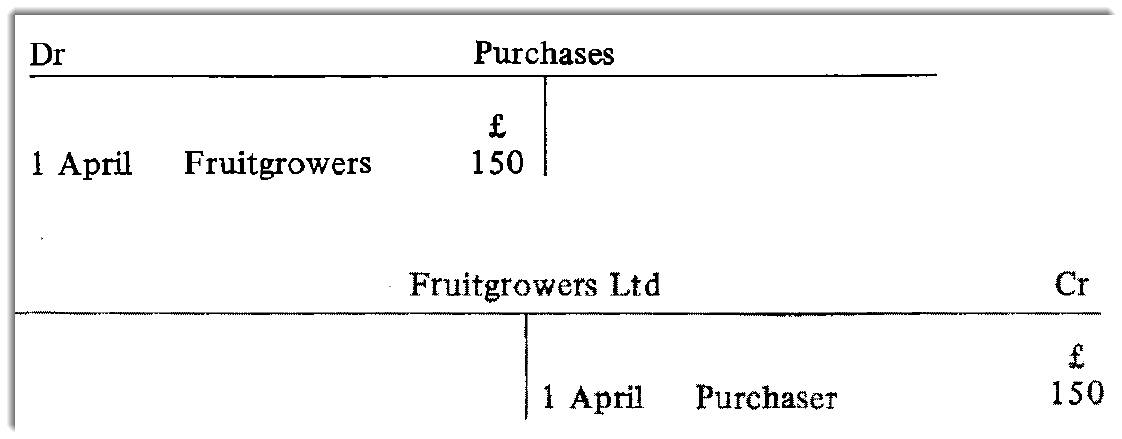

For example, on 1 April a greengrocer bought £150 of fruit on credit from Fruitgrowers Ltd. The entries in the greengrocer’s ledger accounts would be as follows:

PURCHASES RETURNS

Sometimes goods which have been bought arc later returned by the purchaser. This usually happens when something is found to be wrong with them. These purchases returns are also known as returns outward because they are being sent out from the firm which bought them. Sometimes, therefore, the account is called the returns outward account.

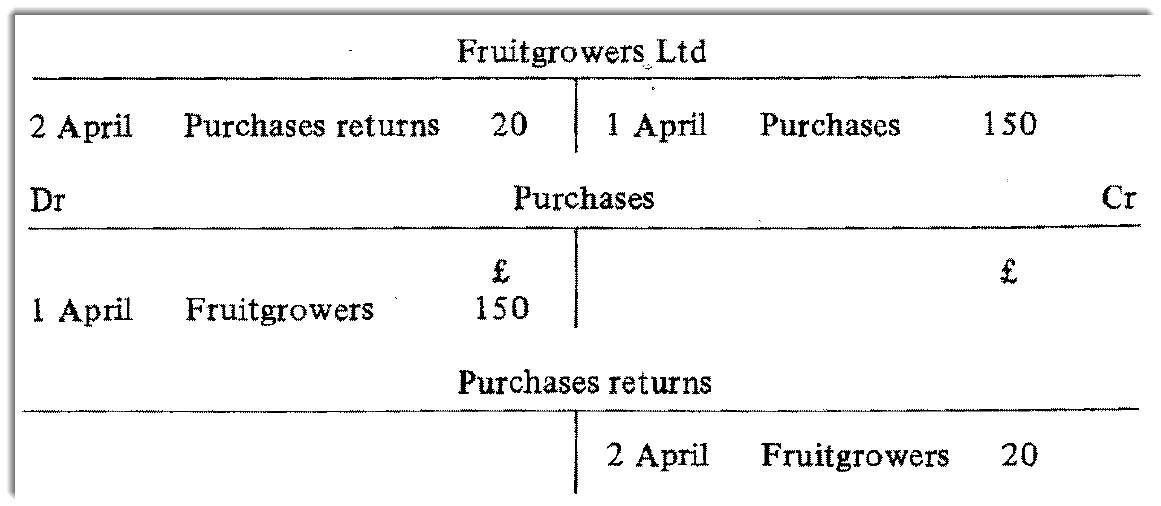

Let’s see how such events are recorded in the purchaser’s accounts. Suppose that the greengrocer mentioned above discovered that £20 worth of the fruit he had purchased was rotten, On 2 April he sent it back to the supplier, The real value of his purchases on 1 April is now £130 (£150 less £20 returned). Also he owes Fruitgrowers Ltd only £130, We can show the reduction of the liability by making a debit entry in the supplier’s account. The credit entry could be made in the purchase account as this would achieve the desired effect of reducing the purchases figure to the right amount. To avoid complicating the purchases account, however, we make the credit entry in the purchases returns account. The accounts will now look like this:

The account for Fruitgrowers shows that £130 is now owing. To obtain the real value of the purchases we have to look at both the purchases account and the purchases returns account, Together they show that the net value, of purchases is £130 (£150 less £20).

If all purchases and returns of goods bought were entered in the stock account the type of entries would be the same, i.e. a debit entry to record an increase of stock when goods are bought and a credit entry to show a reduction of stock when goods are returned. Putting all purchases account and purchases returns in a separate account helps keep things simple.

SALES

Sales of stock decrease the value of this asset. What kind of entry in the stock account would show this? Knowledge of the rules of entry introduced previously should have enabled you to say ‘credit’, which is the correct answer. Instead of making the credit entries in the stock account, however, we are going to make all such entries in the sales of stock account.

In which account will the corresponding debit entry be made? This will depend on how the stock was sold. If sold for money, it will be in either the cash or bank account, showing an increase in the value of one of these assets. If the goods were sold on credit then the person to whom they were sold owes that sum to the business. A debit entry in the customer’s account will represent an asset because we assume that debtors will pay their debts.

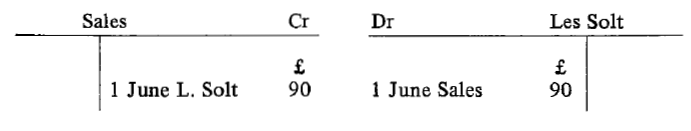

For example, on 1 June a wholesaler sold £90 worth of tinned peas to Les Solt, a retailer who was allowed monthly credit. The entries in the wholesaler’s accounts will be as follows:

SALES RETURNS

When goods which have been sold are returned later for a valid reason, entries must be made to record the event. These sales returns are called returns inward because they are being returned back into stock by a customer. Sometimes, therefore, the account is known as the returns inward account.

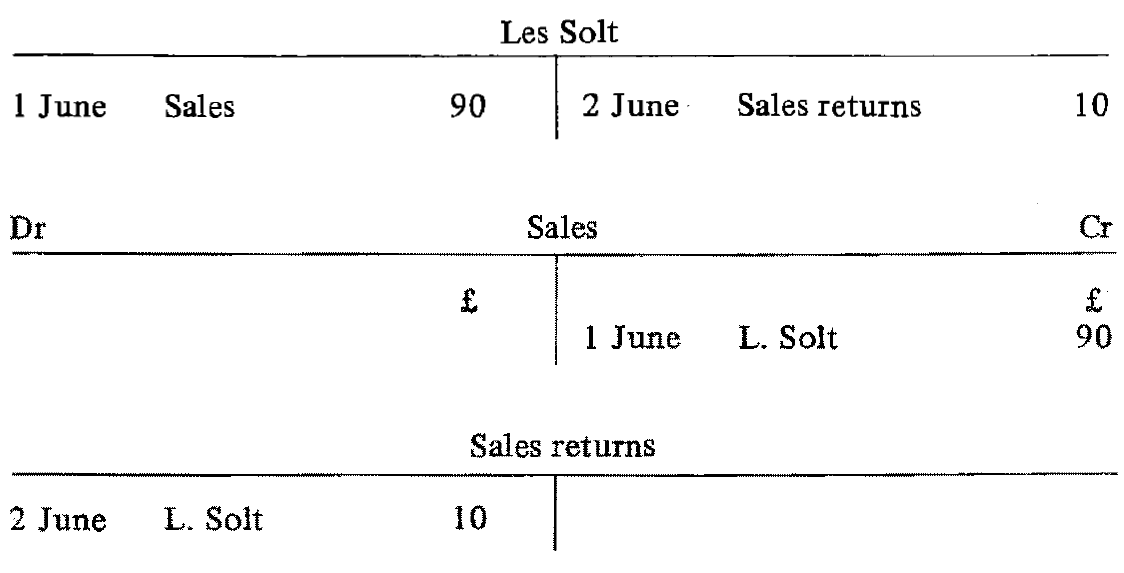

Let’s see how such a transaction is recorded in the seller’s books. Suppose that, on checking the peas he had purchased, Mr Solt found that £10 worth of them were beans. As he had more than enough of these already he returned them to his supplier on 2 June. The wholesaler will have to reduce the amount of Solt’s debt by £10. A credit entry will be made in Solt’s account, following the rules in the last chapter. Remember, a debtor’s account represents an asset and an asset is reduced by a credit entry. The corresponding debit entry for £10 could be made in the sales account, as this would have the desired effect of reducing the sales to its true figure. To avoid complicating the sales account, however, we make the debit entry in the sales returns account instead. The accounts will now look like this:

The account for Les Solt shows that £80 is now owed by him to the wholesaler. To obtain the real value of sales we have to look at both the sales account and the sales returns account. Together they show that the net value of the sales is £80 (£90 less £10).

If all sales and sales returns were entered in the stock account, the type of entries would be the same, i.e. a credit entry to record a decrease of stock when goods are sold and a debit entry to show an increase when goods are returned. Using a sales account to record all the sales and a separate sales returns account for all such returns helps to keep matters simple.

Correctly used the four accounts we have just considered enable the stock account to be reserved for the valuation of stock which is made at stocktaking time.

Exercise 1

1. State whether the entries in the following accounts will be debit or credit:

(a) purchases, (b) purchases returns, (c) sales, (d) sales returns.

(a) Debit, (b) Credit, (c) Credit, (d) Debit.

2. Give the alternative names for:

(a) purchases returns, (b) sales returns.

(a) Returns outward, (b) Returns inward.

Exercise 2

Powa Electrics is a wholesaler which has Jim Hogg, a DIY retailer, as one of its customers. On 1 March, Jim owed £160 from the previous month. The following transactions then took place. On 2 March, Powa Electrics supplied Jim with £170 worth of materials on credit. On 3 March, Jim returned materials worth £40 because they were not of the type he had ordered.

Show how the above would be recorded in the ledger of (a) Powa Electrics and (b) Jim Hogg.

Note: when you do this kind of exercise it is important to be absolutely clear from whose point of view you are considering the transaction. Begin by labelling clearly for (a) Powa Electrics books. Then consider the transactions solely from this company’s point of view. When you have done this put a new heading and consider the transactions from Jim Hogg’s viewpoint.

Check your answer by clicking Accordion style buttons below