Expanding the Ledger - II

Expenses, Discounts allowed, Bad debts, Depreciation, Incomes and Discounts received.

Expenses are payments all businesses will have to make for a number of benefits and services they receive but which do not directly provide an asset owned by the business.

Discount is an expense which many firms incur in order to encourage prompt payment from their debtors.

Bad debt is the expense incurred when debtors fail to pay their debts.

Depreciation is the expense incurred when one of the fixed assets owned by a business falls in value.

Incomes are such receipts of money which come from sources other than sales of stock.

Discount received is a reduction in the amount that has to be paid rather than an actual physical receipt of money.

EXPENSES

All businesses will have to make payments for a number of benefits and services they receive but which do not directly provide an asset owned by the business. These are known as expenses. For example the owner may employ people to work for him. In return for their services he will pay them wages or salaries depending on their conditions of service. He will need to open an account to record the amount they are paid. This will be called the wages or salaries account. Of course some employees may be wage earners and others salaried. In this case the business will usually have two separate accounts.

Activity

Make a list of some services required and expenses incurred by any business known to you.

Example

Click on the button to see an example.

Services required by different businesses will vary but many will be the same. Some of the most common are:

- the use of another’s property, for which rent will be paid;

- the use of local authority services such as refuse collection for which rates will be paid;

- the use of the Royal Mail, for which postage will be paid; and

- the use of a loan from someone else, on which interest will be paid,

Each expense item should be given its own account with a name which concisely explains its function. Accounts for the above services would be entitled ‘rent’, ‘rates’, ‘postage’ and ‘interest on loan’. Other expenses you might have mentioned include: lighting and heating, advertising, repairs, insurance, telephone, carriage inwards (the delivery charge on goods coming into the firm, i.e. purchases) and carriage outwards (the delivery charge paid to have goods going out of the firm, i.e. sales).

The actual name given sometimes varies. For example, ‘electricity account’ may be preferred to ‘lighting and heating account’. Some firms join similar expenses together such as rent and rates or postage and telephone. Small items may be put together under the heading ‘sundry expenses’, particularly if they do not occur often.

You may be able to work out what sort of entry will be needed in an expense account. Assume that a businessman who rents his premises makes his payments in cash. What sort of entry will he make in his cash account? Credit is the correct answer because this reduces the value of an asset. Each time the rent is paid, cash is reduced.

What sort of entry must be made, therefore, in the rent account? The answer must be debit because each transaction needs a debit and a credit entry. This does not give a reasoned explanation, but of course there is one. Expenses have been defined earlier as payments for services that do not directly provide an asset owned by the business. These services are advantages to the business, however, and very similar to assets in that respect.

Therefore the rules for their entry are the same as for assets: a debit entry to record an increase and a credit entry to record a reduction in its own account. In the above example, each time the rent is paid the total amount paid is increased and therefore a debit entry is needed in the rent account.

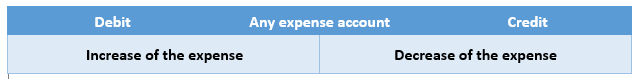

We can summarise the rules for making entries in expense accounts as follows:

The double entry will normally be completed by an entry in the cash or bank account. There are three main exceptions to this.

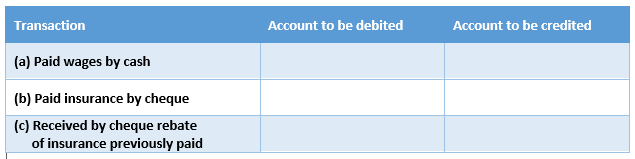

Exercise

Copy and complete the following table:

Click on the button to see the answer.

DISCOUNT ALLOWED

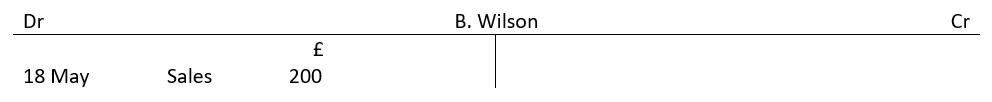

This is an expense which many firms incur in order to encouage prompt payment from their debtors. For example, a retailer called Ben Wilson owed a wholesaler £200 for a purchase made on 18 May. In the wholesaler’s books the debt will appear like this:

The wholesaler has a policy of allowing debtors to deduct a discount of 3% for settlement within seven days of a statement being sent. This was done on 31 May and Wilson paid by cheque on 4 June. How much did he pay?

Wilson’s cheque would have been for £194 as he is entitled to deduct £6 discount from the £200 due.

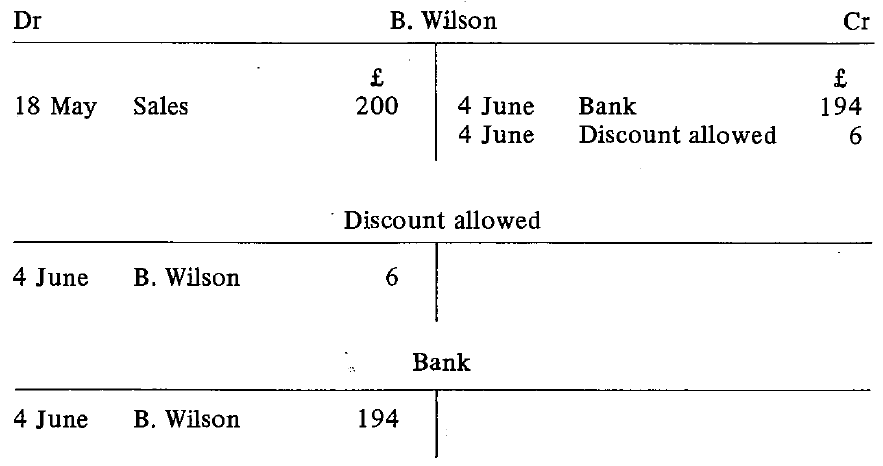

The discount allowed to B. Wilson will be shown in the wholesaler’s ledger. On 4 June two separate credit entries will be made in Wilson’s account to show how settlement of the £200 due has-been made. First, an entry for £194 with a corresponding debit entry in the bank account for the amount of the cheque. Second, an entry for £6 with a corresponding debit entry for the discount allowed. The accounts will then look like this:

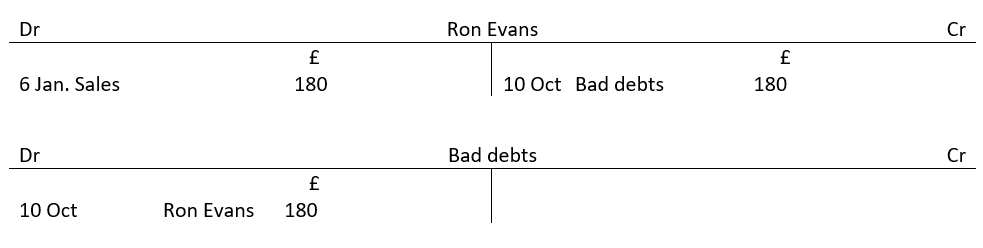

BAD DEBTS

This is the expense incurred when debtors fail to pay their debts. In the balance sheet, debtors appear as an asset because it is assumed that anyone to whom credit has been allowed will pay what they owe. Once it is known that a debt is never going to be collected this fact must be shown in the accounts. If it were not then the accounts would not be giving a fair picture of the assets of the business. For example, Ron Evans, who for a short and unsuccessful time was a retailer, owes a wholesaler £180. The wholesaler has been unable to collect his money and has just heard that there is no likelihood that he ever will. He must remove the asset by making a credit entry in the debtor’s account. The corresponding debit entry will be in an account termed ‘bad debts’. The accounts will look like this:

In effect an asset has been converted into an expense. Naturally any firm allowing credit to another takes all reasonable precautions to make certain that this kind of thing does not happen too often. It is accepted, however, that ‘writing off’ a bad debt, as this process is called, is an occasional and inevitable part of allowing credit to others.

Activity

Put yourself in the position of a wholesaler who has just received a request from a retailer that he should be allowed to make use of the monthly credit terms allowed to other retailers. What steps would you take to minimise the possibility of bad debts? Right down your ideas and then check by clicking the button bellow.

There are a number of possibilities.

- References could be requested from other firms with which the retailer has been dealing.

- You might give monthly credit only when he has proved to be a reliable payer on a weekly basis.

- Perhaps a maximum credit limit could be set for a trial period to reduce the risk of large debts not being paid.

Whatever you do, the risk of non-payment by some debtors always exists. It is important, therefore, to act quickly when a slow or bad payer is identified and try to prevent the loss involved being too great This might involve correspondence from yourself or even a solicitor. In the case of larger debts you will have to decide whether legal action, which can sometimes be very costly, is worthwhile. If all this fails the value of the asset, debtor, must be reduced in the manner described.

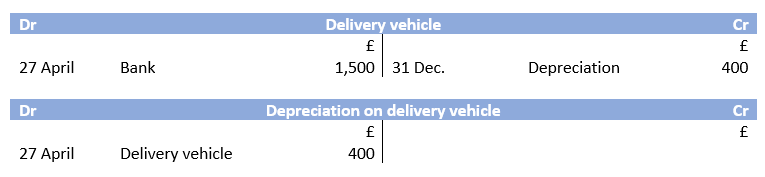

DEPRECIATION

This is the expense incurred when one of the fixed assets owned by a business falls in value. Just as ‘debtors’ cannot be allowed to include any amounts which it is known will not be collected, so it would be wrong to allow an asset, such as motor vehicles, equipment, machinery or furniture and fittings, to be valued at a figure greater than its true worth.

By now you should have grasped what kind of entry in an asset account is needed to reduce the value of that asset: a credit entry. Refer back to previous sections if you thought otherwise. The corresponding debit entry will be in an account named ‘depreciation on . . .’ (the name of the fixed asset involved).

For example, В. Wilson purchased a delivery van on 27 April for £1,500. By 31 December of that year it was worth only £1,100. Its value had fallen or depreciated by £400. This would be shown in the accounts like this:

Exercise

Which asset is reduced in value under the following circumstances? Write down your answers and then click the button below to check.

(a) Rent is paid by cheque.

(b) A customer is allowed 3% discount for prompt payment.

(c) Wages are paid in cash.

(d) A customer unable to pay an amount owed.

(e) It is discovered that machinery purchased for £1,000 is now worth £800.

(a) Bank, (b) debtor, (c) cash, (d) debtor, (e) machinery.

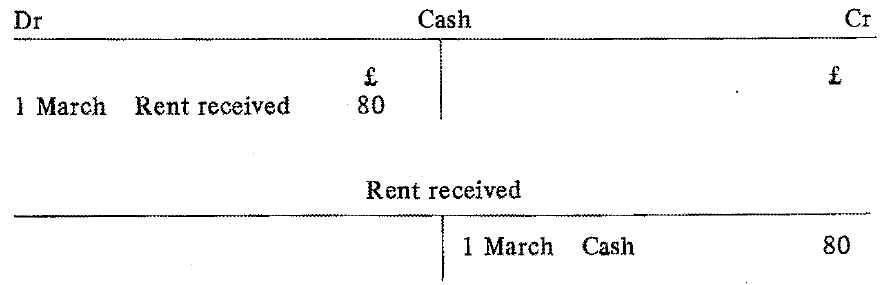

INCOMES

While all businesses will have to pay for a variety of expenses to enable them to operate, some will also receive income for the services they provide for others. For many businesses the major receipt of money will come from sales of their stock, an item dealt with at the beginning of this chapter. Here we are concerned with those receipts of money which come from sources other than sales of stock. For example, a business may own property which it does not need for its own use but which it does not wish to sell. Renting this property to another firm will enable it to gain useful income. Similarly one firm may provide a service for another and charge commission. Care is needed in the accounts to distinguish such receipts from payments. It is usual to label an account for income received from letting out property ‘rent received account’ to avoid confusion with the rent account which is for the expense involved when another’s property is used by the firm itself. Similarly, commission account will be for the expense, and commission received account for the income.

The entries to be made in accounts recording incomes will be opposite to those demonstrated for expenses. When the money is received an asset account such as bank is increased by a debit entry. At the same time a compensating credit entry is made in the income account.

For example, a retailer lets the flat above his shop for £80 a month. This is paid in cash on the first of each month. The relevant entries for March in the retailer’s accounts will be:

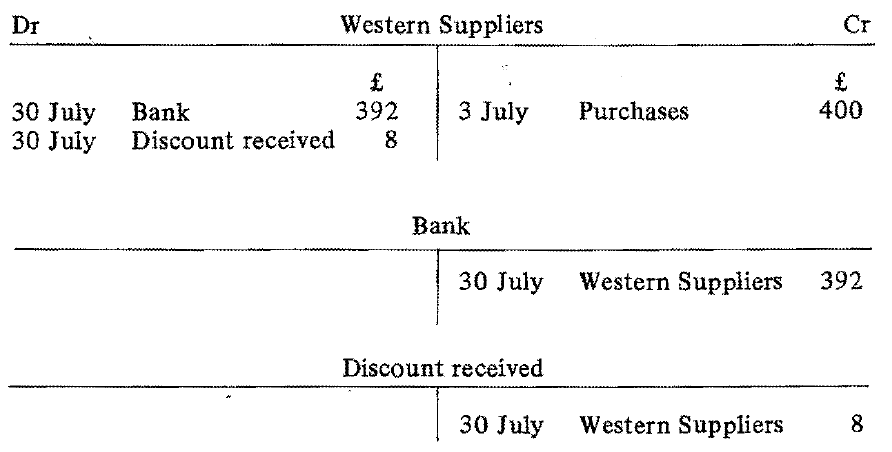

DISCOUNT RECEIVED

An. income which many businesses enjoy comes from settling the amounts due to their suppliers promptly. This is known as discount received. It takes the form of a reduction in the amount that has to be paid rather than an actual physical receipt of money. Thus the debit entry corresponding to the credit entry in the discount received account will be in the creditor’s account, showing the reduction of a liability. For example, a retailer purchases goods for £400 from Western Suppliers on 3 July. A discount of 2% is offered for settlement received by 31 July so the retailer pays by cheque on 30 July. Relevant entries in the accounts of the retailer follow.

It is important to make the two debit entries in the account for Western Suppliers simultaneously. Otherwise it might seem that £8 was still owing at the end of the month and a payment might be made.

SUMMARY

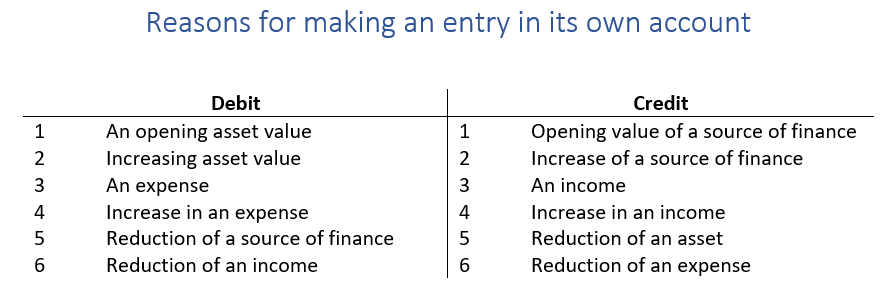

It is possible to summarise all the reason for making a debit or credit entry in the form of a ledger account.

You can use this as a quick means of reference when in doubt about whether a credit or debit entry is needed. Remember, sources of finance include capital and liabilities. Try it now if you need to.

To make sure you understand the core principles of double entry bookkeeping, please download the attached document and complete the review exercises.

Review exercises 2