Mastering Accounting: BUSINESSES AND BALANCE SHEETS

1.1 THE NEED FOR ACCOUNTS

Nothing so special. We all do it, or could do it.

There is nothing so special about accounting that it must be done only by accountants. We all do it, or could do it. Take for example John, a sixth-form student who works in a shop each Saturday. Most of his earnings used to disappear fairly quickly on clothes, records and concerts. Recently, however, John started to save. He wanted a motorbike. His parents agreed to buy him one for his next birthday, which was six months away, provided that by that time he could show them that he would be able to pay all the usual expenses involved in running a bike.

To help John do this, his mum gave him a pocket book. He wrote down his earnings each week and kept a note of his spending. When his birthday came he was able to show his parents exactly how much he had saved and how he had done it. By then he had also looked into the costs of running a motorbike including fuel, road tax, insurance and repairs. Writing down his savings for the previous six months on one side of a sheet of paper and the estimated running costs on the other, he was able to prove to his parents that he would indeed be able to run the bike - just.

John got his bike. He didn’t throw away his pocket book, though. He soon found how useful it was in helping to keep a check on what it cost him to run the bike. He was often having to decide things like whether he should use the bike every day to travel to school (his bus pass was free); when to have the bent mud-guard repaired; who would service the bike.

John got his bike. He didn’t throw away his pocket book, though. He soon found how useful it was in helping to keep a check on what it cost him to run the bike. He was often having to decide things like whether he should use the bike every day to travel to school (his bus pass was free); when to have the bent mud-guard repaired; who would service the bike most thoroughly and yet not charge too much; and how much he could put towards the crash helmet his girlfriend needed. He was able to use the information in his pocket book to help him make these decisions.

Exercise 1.1

Answer the question: When did John act as (a) book-keeper; (b) financial accountant; (c) management accountant? Click on the button below to see the answer.

He acted as (a) when keeping a record of his earnings, etc. in his pocket book. Recording transactions is what book-keeping is all about.

He acted as (b) when proving to his parents on a sheet of paper that he could afford to run the bike. Reporting to interested parties is the function of a financial accountant.

He acted as (c) when using the information in his pocket book to decide things like when he could afford to have his mud-guard repaired. Using accounts as an aid to decision making is the work of a management accountant.

If you had any difficulty with this question, reread the definitions on the Intro page.

Even if you do not use what you learn in this class in a business situation you may find it useful in your personal life. See if you can prove this yourself by attempting the following Activity.

Activity 1

Make a list of ways in which you could (or already do) benefit from using basic accounting techniques. Compare your ideas with the examples provided below.

There are many benefits you might mention. For example:

- On the book-keeping side it is always helpful to keep records of receipts and payments made through a bank account. When you receive your statement it is then much easier to check it. A record of spending on particular items might also be useful, e.g. heating, motoring or purchases of food for the freezer.

- It is sometimes helpful to prepare a clear statement of your financial position. Such a statement may help to persuade a bank manager to give you a loan or it might help to prove to yourself or others how much better off you are after giving up smoking. So drawing up a report rather like a financial accountant is useful.

- Everybody has to make decisions and very often these involve money. A housewife who is finding it difficult to make ends meet might be faced with the task of deciding whether her children should have school lunches or take their own. Another might have to decide whether they can afford a holiday this year and, if so, what sort.

Simple records and brief statements will be very useful in making such decisions. No matter that they are written on the back of an envelope! Perhaps management accounting seems too grand a title for it.

What's in a name? The word 'economics' derives from a Greek word meaning management of a household. Housewives are managers, so why shouldn't they use the techniques of management accounting?

Let’s turn now to the business world. There are many different sorts of businesses. One way of classifying them is according to how they are owned. Among the most numerous are sole traders, who are also known as sole proprietors or sole owners. Here one person owns the business. Other types include partnerships, limited companies, co-operatives and public corporations.

A typical example of such an organisation owned by one person is the building and decorating business owned by Henry Plunkett. Besides general repairs and decorating he also does quite a number of extensions. He employs six people. Try to acquaint yourself with the administration of this sort of business by attempting the following.

Activity 2

Make a list of different sorts of information that such a business will need to record. Compare your list with the example below.

Information Htnry Plunkett would probably require.

It would be expected of Henry Plunkett to keep records or accounts of (1) purchases of materials, (2) payments made to suppliers of materials and services, (3) invoices sent to customers, (4) money received from customers, (5) possessions of the business such as cash, premises, equipment and vehicles, (6) money owed to creditors, e.g. the bank, wages paid to employees, income tax and national insurance deducted from employees’ wages and value added tax paid on purchases or charged to customers.

Your list may be longer than the one above but even if it only contains a few items it is still clear that records will need to be kept. Therefore bookkeeping is essential.

Exercise 1.2

Ginger Jenkins has started a business similar to that of Henry. He does not keep proper records but reckons that, as long as he has plenty of cash coming in, he must be doing all right and therefore has no need of financial accounts or accountants. Who will dispute Ginger’s freedom to run his business this way?

Click on the button to open the answer.

His Inspector of Taxes, who will require evidence on which to base his assessment of how much tax he should pay.

When people do not provide enough satisfactory evidence the inspector has power to estimate how much profits have been made and tax them accordingly. It is usual in such circumstances to make such an estimate err on the high side rather than the low. This usually brings characters like Ginger to their senses.

Of course, Ginger does not have to employ an accountant to prepare a profit and loss account and balance sheet. He could do it himself if he knows how to do so.

To be successful, Henry Plunkett will also find management accounting a great help as decision making is important in all businesses. Some people have a knack for making the right decisions, relying mainly on intuition.

Others frequently choose incorrectly. However lucky a businessman may be, decisions made with knowledge of all relevant facts, including financial information, have most chance of being right in the long run.

The decisions Henry will have to make will be many and varied. Consider just one. Henry has been invited to submit an estimate to convert a farmer’s barn into a home for his son and daughter-in-law. How will Henry go about this task? To begin he will need to know what the end product is to be like and what materials are to be used in its construction. An architect’s drawing will provide much of the information he needs.

Given this, he will be able to calculate the amount of materials needed and the number of hours he thinks it will take to complete. He can then work out the cost of these materials and the amount of wages he will have to pay his men while they are working on this job. Information on the cost of materials will come from catalogues and recent invoices received for similar materials. For the wages cost he will be able to consult records of the various wage rates paid to his men, some of whom will be skilled and others unskilled. He will, of course, want to earn a profit for himself in return for taking on the risk involved in carrying out the job. Other considerations that might affect the final total figure he gives for the job include how badly he needs the work and whether it is likely that other firms will be able to give an estimate below his. Henry’s experience will be invaluable in drafting the estimate for the farmer. Without the facts provided by his accounting records, however, it is clear that the preparation of the estimate would be much more of a hit-or-miss affair.

Activity

Think of some other decisions that Henry might have to make in managing his business. Consider if accounting would help him in making them. Write you ideas on a sheet of paper then press the button below to compare.

Should he take on extra staff when trade is booming or rely on subcontracting some of the work to other firms?

Should he purchase or lease the new equipment if needed?

If he decides to purchase, what is the best way of paying for it?

Should he expand with money that will have to be borrowed?

What is the best way of persuading his customers to pay him more promptly?

Which is better, buying materials for cash to obtain lower prices or on credit to give him time to pay?

Of course there are many more, but whatever management decision you thought of it is inevitable that it would best be made by reference to book-keeping records and the financial accounts. In larger businesses management accountants would probably draft individual statements to assist in making each such decision. In smaller businesses this is less likely.

Having seen the use of accounting to all of us as individuals and to business owners like Henry, it should not be too difficult for you to look further afield for other examples of its use. For instance many businesses are much larger than Henry’s and are involved in different activities. Many employees in such businesses will be working with accounts and not all of them will be in the financial department. They may well be employed in marketing, production or personnel departments.

There are other forms of business ownership. Partnerships need accounts to satisfy each partner that the profits are being fairly divided and companies are accountable to their shareholders. Local and central government provide a variety of services and will need accounts, not least for keeping a check on the money they receive from ratepayers and taxpayers.

Exercise 1.3

3.1 Complete the following sentences:

(a) Recording transactions is known as____________________________ because at one time most accounts were kept in __________________.

(b) Reporting on the state of a business by means of statements such as __________________and_________________________accounts and balance

sheets is known as______________________.

(c) Using accounts as an aid in controlling and managing a business is known as _____________________________________________

(d) The above activities together make up the subject matter of ___________________________

3.2 What sort of business, from the point of view of ownership, is that of Henry Plunkett?

3.3 Give three examples of information that a business like Henry’s would need to record. In each case say why this information should be recorded.

3.4 Which of the following is unlikely to be involved in any way with accounting: business owner, salesman, wages clerk, personnel manager, marketing director, inspector of taxes, treasurer of a tennis club, housewife?

Answers to the Exercise 1.3

3.1 The missing words in order are: (a) book-keeping, books; (b) profit, loss, financial accounting; (c) management accounting; (d) accounting.

3.2 Henry is a sole proprietor or sole trader because he alone owns the business.

3.3 The three examples that come most readily to my mind are:

(a) Money received and paid. Money is the lifeblood of all businesses and a close check must be kept on it.

(b) Amounts owing to suppliers. Credit is important to many businesses, none of which want to lose this facility. Care must be taken not to offend suppliers by being too slow in payment.

(c) Amounts due from customers. Many customers have to be asked more than once for the money they owe.

3.4 Your general knowledge together should have led you to say ‘None’. If you have any doubts about this find out what each of them does and reconsider.

The balance sheet and the effects of business transactions

The accounting equation is expressed in a financial position statement called the Balance Sheet. It is not the first accounting record to be made, but it is a convenient place to start to consider accounting. All business transactions can be reduced to the following few/

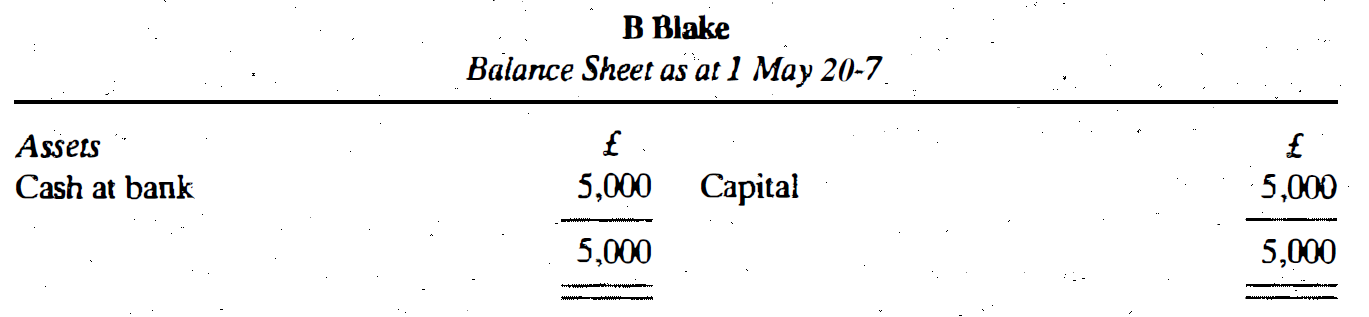

The introduction of capital

On 1 May 20-7 В Blake started in business and deposited £5,000 into a bank account opened specially for the business. The balance Sheet would appear:

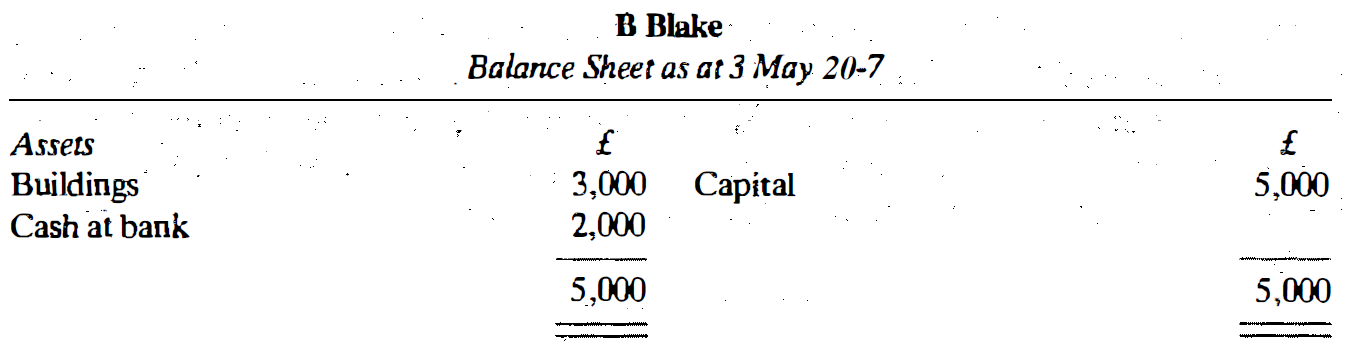

The purchase of an asset by cheque

On 3 May 2 0-7 Blake buys a building for £3,000. The effect of this transaction is that the cash at the bank is decreased and a new asset, i.e. buildings, appears.

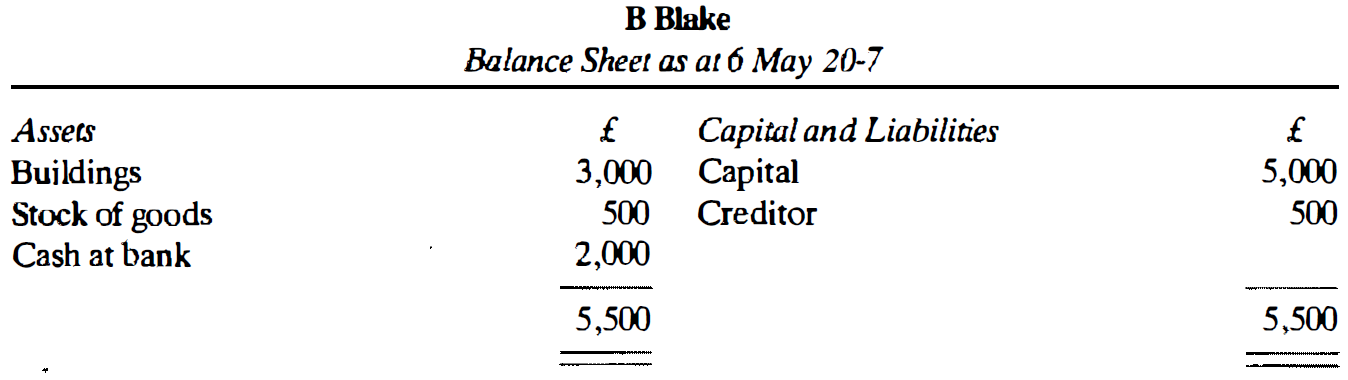

The purchase of an asset and the incurring of a liability

On 6 May 20-7 Blake buys some goods for £500 from D Smith, and agrees to pay for them some time within the next two weeks. The effect of this is that a new asset, stock erf goods, is acquired, and a liability for the goods is created. A person to whom money is owed for goods is known in accounting language as a creditor.

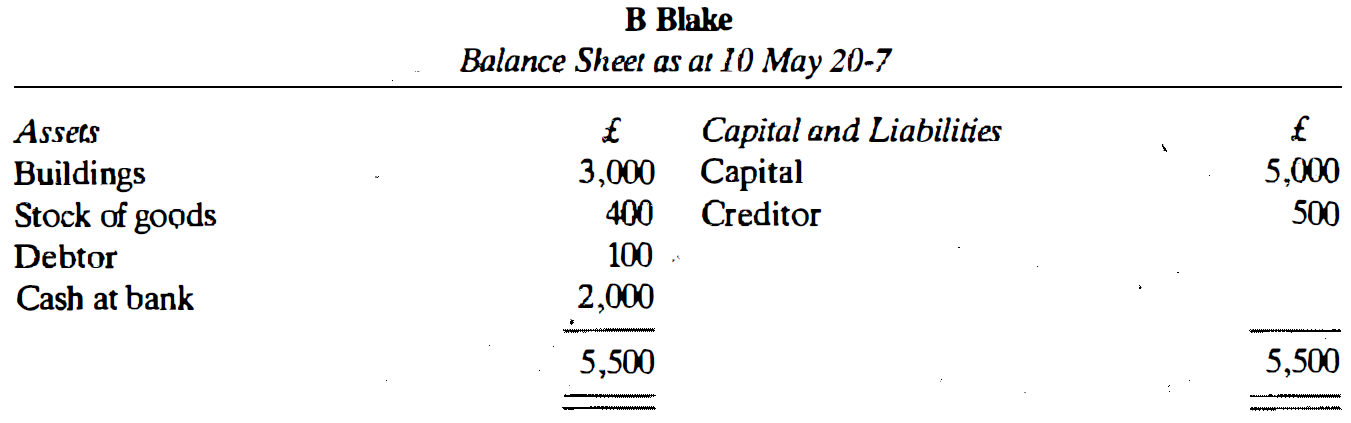

Sale of an asset on credit

On 10 May 20-7 goods which had cost £100 were sold to J Brown for the same amount, the money to be paid later. The effect is a reduction in the stock of goods and the creation of a new asset. A person who owes the firm money is known in accounting language as a debtor. The balance sheet now appears:

Sale of an asset for immediate payment

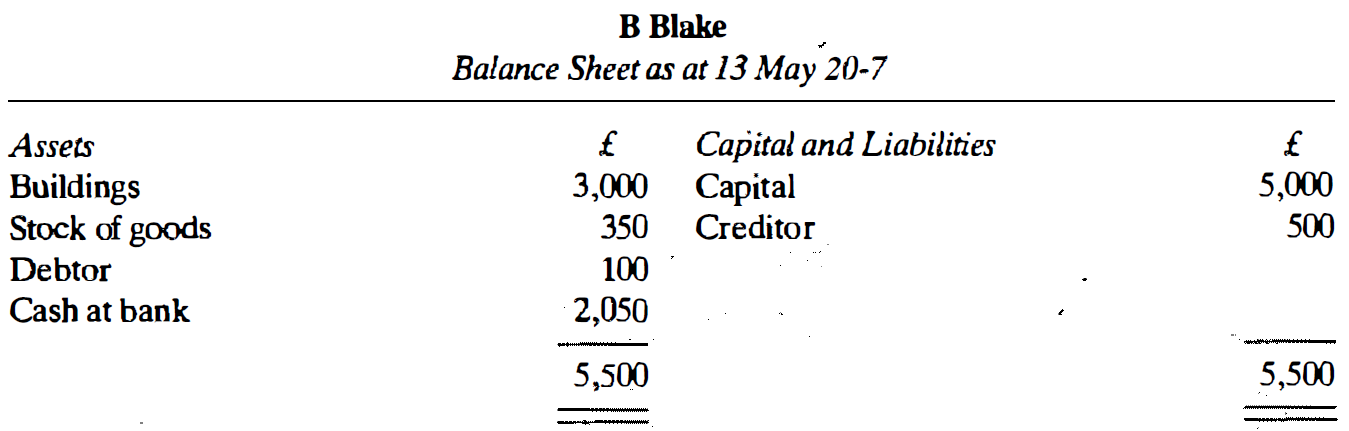

On 13 May 20-7 goods which had cost £50 were sold to D Daley for the same amount, Daley paying for them immediately by cheque. Here one asset, stock of goods, is reduced, while another asset, bank, is increased. The balance sheet now appears:

The payment of a liability

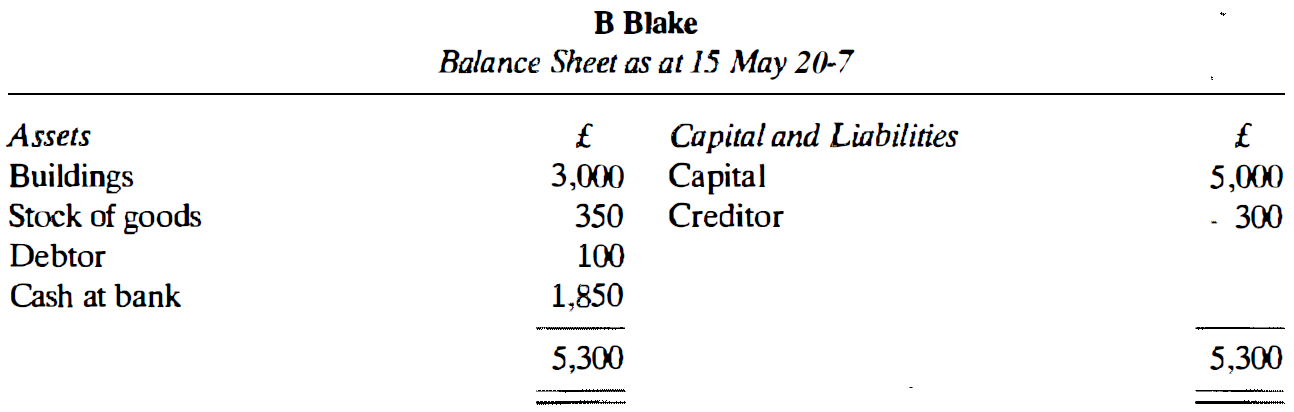

On 15 May 20-7 Blake pays a cheque for £200 to D Smith in part payment of the amount owing. The asset of bank is therefore reduced, and the liability of the creditor is also reduced. The balance sheet now appears:

Collection of an asset

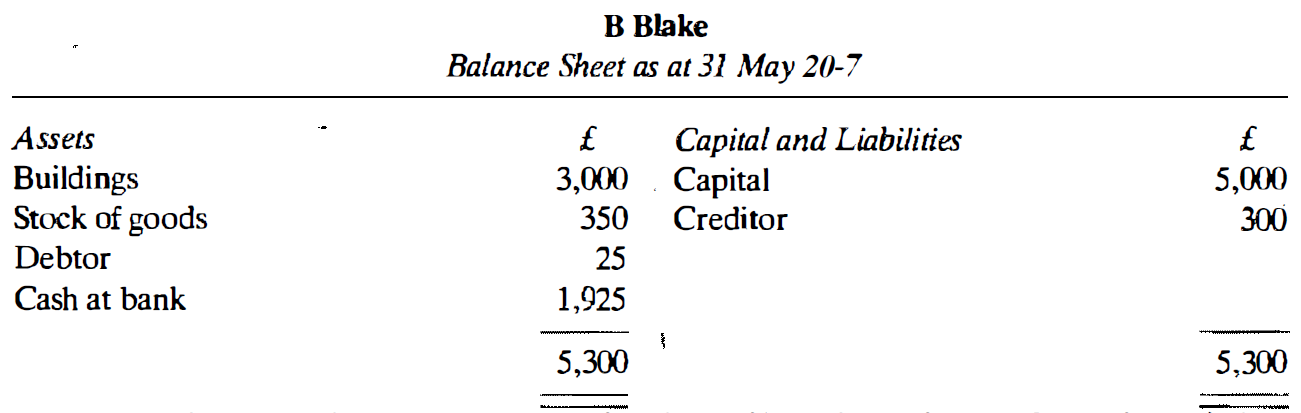

J Brown, who owed Blake £100, makes a part payment of £75 by cheque on 31 May 20-7. The effect is to reduce one asset, debtor, and to increase another asset, bank. This results in a balance sheet as follows:

It can be seen that every transaction has affected two items. Sometimes it has changed two assets by reducing one and increasing the other. Other times it has reacted differently. A summary of the effect of transactions upon assets, liabilities and capital is shown below.

Example of transaction

| 1 |

Buy goods on credit. |

Increase Asset

(Stock of Goods) |

Increase Liability

(Creditors) |

| 2 |

Buy goods by cheque. |

Increase Asset

(Stock of Goods) |

Decrease Asset

(Bank) |

| 3 |

Pay creditor by cheque. |

Decrease Asset

(Bank) |

Decrease Liability

(Creditors) |

| 4 |

Owner pays more capital into the bank. |

Increase Asset

(Bank) |

Increase Capital |

| 5 |

Owner takes money out of the business bank for his own use. |

Decrease Asset

(Bank) |

Decrease Capital |

| 6 |

Owner pays creditor from private money outside the firm. |

Decrease Liability

(Creditors) |

Increase Capital |