THE TRIAL BALANCE

Balancing the accounts

In this unit we are going to look at a simple way of making a preliminary check on the accuracy of the entries made in the ledger. We will do this by balancing the accounts and then drafting a trial balance. We will start, however, by demonstrating how the folio column in the ledger can be used to provide a reference system for all the double entries. Such a system helps to speed up the process pf checking that all the double entries have been completed correctly.

THE FOLIO COLUMN

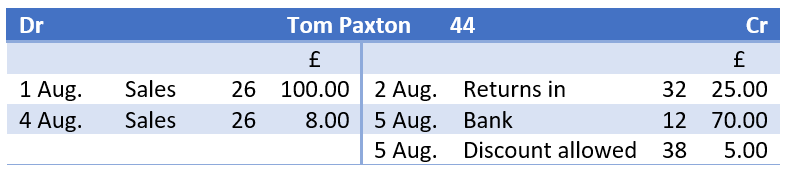

Remember, the folio column in the ledger is just a page or leaf of a book and that all pages in the ledger will be numbered. We can use these numbers to provide us with our reference system. An example should make this clear. This a/c appears in the ledger of a wholesaler.

Tom’s account is on page 44 of the ledger (or on a ledger card numbered 44). The entry in the folio column for each transaction tells us on which page of the ledger the other entry can be found. From this you can deduce that the account for sales is on page 26, returns inward on page 32, bank on page 12 and discount allowed on page 38. Looking for a numbered page or card is much quicker than looking for the name of an account when you are checking to make certain that all entries have been completed correctly.

BALANCING ACCOUNTS

Let's turn now to checking the accuracy of transactions made in the ledger. To do this, you must learn the technique of balancing the ledger accounts. The balance of an account is the difference between the two sides. This is the most significant figure in the account because it tells us the value of the asset, liability, expense or income of which the account is a record. When the debit side is greater it is termed a debit balance. Conversely, credit balance indicates the difference when that side of the account is greater.

To illustrate this, look at Helen Berry’s ledger accounts as at 1 March 2019. They contain the following balances:

Premises £15,000 dr balance; furniture and fittings £3,000 dr balance; bank £2,075 dr balance; capital £19,000 cr balance; Busifinance £2,000 cr balance; purchases £1,500 dr balance; AKJ £400 cr balance; sales £250 cr balance; cash £90 dr balance; purchases returns £100 cr balance; discount reed. £20 cr balance; N. Timms £100 dr balance; insurance £25 dr balance; rent received £20 cr balance.

In many of the accounts there was only one entry on one side. In some of these, e.g. premises and capital, that one entry was described as balance in the details column. This was because that opening entry had come directly from the list of balances in the balance sheet.

Figure 1. The Balance sheet and the Ledger

Figure 2. The Ledger continued.

We can now proceed to the method used to show what the balance is at a particular time. This is known as balancing the accounts. Let’s assume that Helen Berry’s accounts are to be balanced on 10 March. This is what her bank account will look like after it has been balanced:

Figure 3. The bank account after being balanced.

Steps you have to follow:

- Find the difference between the two sides.

- Place this figure on the side of the account that is smaller. It is described as balance c/d which means that the balance is to be carried down. The date is that on which the account is being balanced.

- Total the two sides, drawing the lines carefully so that the two totals are level with each other. As the difference between the two sides has been added to the smaller side both sides will now be equal.

- Enter the balance on to the side to which it really belongs, describing it as the balance b/d which means that the balance has been brought down. It is dated one day after that of the balance carried down figure. The folio column is used for c/d and b/d.

In the above account we can now tell at a glance that, when business starts on 11 March, Helen Berry has £2,075 in her bank account. The significance of dating the balance to be carried down one day earlier than the balance which has been brought down is that account is shown as being temporarily closed at the end of business on one day and then reopened, with the same amount, when business begins next day.

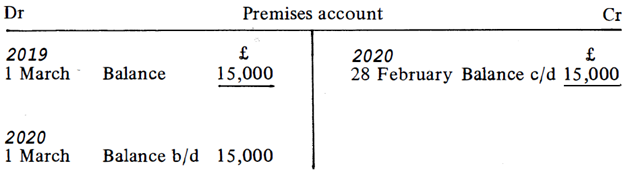

Where there is only one entry in an account, that is the balance or difference between the two sides. It perhaps seems unnecessary to go through the process of balancing such an account. However, this is still done by some people and it does serve as a means of showing that all the accounts have been looked at and brought up to date at the same time. For example, it is not likely that the premises account will contain many new entries from one year to the next. Suppose Helen Berry decides to balance it at the end of her current financial year which will be on 28 February 2020. This is how it will look:

The procedure is the same as above except that there is no need to total the two sides. When the balance to be carried down is inserted on the smaller, credit, side both sides are immediately equal. Underlining the two figures is enough to show they are the totals.

When should accounts be balanced? There is no hard and fast rule. Occasions when it is often done include: the need for a new page of an account when the existing page is full and at the end of a firm’s financial year. There is in fact nothing to prevent an account being balanced at any time when it is felt that the information it reveals will be useful. One such occasion might be when a check is to be made on the accuracy of entries made in the ledger accounts. It is to this that we will now turn.

A brief summary of what has been learnt so far about double entry book-keeping will help to show how the balances in the accounts can be. used as a means of checking the accuracy of the entries within. The following diagram is virtually self-explanatory.

Figure 5. Balance sheet, Ledger, Transactions.

We begin with the balance sheet which reflected the book-keeping equation, i.e. assets must equal the sources of finance (capital and liabilities). In the ledger each asset was shown as a debit balance in its own account and each source of finance as a credit balance. Therefore, the debit balances will equal the credit balances. When transactions are entered in the ledger additional accounts may be opened but whatever the transaction it will involve a debit entry of the same amount as the corresponding credit entry. Therefore, after any number of transactions the total value of the debit balances should still equal the total value of the credit balances.

Checking that the debit balances do in fact equal the credit balances is done by making a list of all the balances. This is known as a trial balance and usually takes the following form.

Figure 6. The Trial Balance.

Note There is no balance at present in the Northern Foods account, it is not essential to show that account in the trial balance. The fact that the total debit balances equals the total of the credit balances is sufficient evidence to prove that the transactions have been entered correctly in the ledger. To give you practice in entering transactions and checking their accuracy by drafting a trial balance, work through the following exercise.

Exercise

Mike Bishop opened his petrol service station on 1 May 2019. He had £1,000 in the bank,£200 in cash, £8,000 worth of stock and machinery and equipment worth £12,000. He had borrowed £4,000 from Petro finance Ltd for nine months and provided the rest of the finance himself.

1 Draft a balance sheet to show Mike’s position on 1 May 2019 taking care to calculate the figure for owner’s capital.

2 Open a ledger account for each item and enter the opening balances.

3 Enter the following transactions in the ledger, opening new accounts where necessary. Then extract a trial balance on 7 May to check the accuracy of your entries.

2 May Cash sales £600.

3 May Cash sales £550; purchases £1,200 on credit from PB Ltd.

4 May Cash sales £720; paid £1,500 cash into bank.

5 May Cash sales £680; paid rent £160 by cheque.

6 May Cash sales £540; purchases £200 on credit from Greasoils Ltd.

7 May Paid amount owing to PB Ltd, less 3% discount by cheque.

The following procedure is recommended if your trial balance totals do not agree:

- Make certain that you calculated the owner’s capital correctly and that the balance sheet balanced with the same totals as mine.

- Check that the assets and sources of finance were entered on the correct side of their accounts. The opening debit balances (assets) should, of course, equal the total credit balances (capital and liabilities).

- Go through each transaction following the rules on page 37. Make sure that for each debit entry there is a corresponding credit entry of the same value.

- Check that you have calculated the balances on each account accurately, paying particular attention to those accounts with most entries. Remember the balance of an account is the difference between the two sides. It is described as a debit balance when the total value of debit entries is greater than the credits. If the credit .side is greater than the debit the difference is a credit balance.

- Make certain that you have put the balances in the right column of the trial balance.

In case you have problems with the exercise you may download and study the answer

Trial Balance Exercise